Now You See It, Now You Don’t: The Death of Supply Chain Visibility as a Category

The market is staying rational longer than the VC backed visibility vendors can stay solvent

Improved visibility is a longstanding wish among supply chain managers. Visibility can mean many things: inventory at rest visibility, in-transit visibility, work-in-progress visibility at suppliers, demand visibility at points of sale, and so forth. But don't take these wishes at face value. The unsatisfied but everpresent demand is a red flag; a paradox that proves we got some definitions wrong. Do supply chain managers really value visibility? Is it really a hard problem to solve? In this article I'm explaining my contrarian perspective that supply chain visibility is going to have a chaotic reset as two realities come together: most software vendors are VC-backed companies that thought they'd build unicorns and give huge payouts to their investors, while supply chain managers are realising visibility is a commoditized feature rather than a category to be bought for a premium. My concrete prediction is that at least the three largest VC backed vendors will have to settle with this reality by being acquired and dismantled by another category leader (for example, by a major TMS vendor) or by cutting valuation and pivoting their product scope towards a category that will survive.

I'll push this argument forward in three steps:

The visibility problem statement hasn't changed in ten years, and vendors have converged to the same solutions. There is no significant solution differentiation.

The TAM analysis of VC-backed startups overestimated the actual market size and willingness to buy. This is especially true for spending more to achieve better visibility compared to “good enough” visibility.

The VC backed vendors like Shippeo, Project 44, and FourKites won't be able to deliver the right financials from visibility and retain independence. Either their name survives and they pivot to a new category, or they fail at independence and become someone else's visibility feature.

Let me explain them in turn.

Let's Not Over Complicate It

When I was under Mac McGary at GT Nexus he used to frame the sales efforts as “make the simple complex; make the complex simple". The point was that some enterprise software was deep and technical and complicated. In those situations the art of the sale was to keep the dialogue above the weeds and sell to authority with a clarifying message. In other cases the solution was so simple the buyer tended to bake-off vendors on price alone. In these cases the art of the sale was to convince a buyer that this wasn't so simple of a decision and to look at the details to see why we are better.

Without a doubt supply chain visibility is an example of the simple: a shipper wants to know information about something they would not usually be able to. Visibility gives it to them. The kinds of information supply chain managers want and the sources of that data have changed very little since I wrote a textbook about supply chain visibility in 2012. Smartphones, truck telematics, ocean carrier status feeds, web scraping to get data not available via API, devices on containers-pallets-or-cartons to monitor temperature and physical shocks… all of these existed in 2012. The principal difference today is that incremental improvements and competition have lowered their price and improved their reliability, i.e. a buyer mostly sees the same solutions to the same problems with falling price to achieve a given level of visibility. I think this is a good thing for supply chain managers.

And yet, this is not how the pure-play supply chain visibility vendors need the narrative to go. In order to deserve the attention of leaders and to justify IT spend, the visibility problems need to be increasingly urgent or novel. Their sales efforts need to make visibility more complicated than it really is. And I don't think the supply chain management community buys that narrative anymore.

Racing to the Bottom Price

In theory, simple visibility solutions might still be differentiated. In theory, one vendor might have a proprietary data sourcing strategy like Wal-Mart building a private satellite configuration in the 1980s to sync data with their stores before anyone other retailer could do so. But in practice visibility solutions are the same to customers in all meaningful ways. They aggregate data from the same sources. They calculate the same sort of KPIs, alerts, and recommendations. Their differences strike me as akin to countries driving on the left vs. right side of the road: visually striking but ultimately arbitrary.

When a buyer has at their disposal multiple perfectly suitable software solutions they naturally turn to non-functional considerations. Is this vendor easy to work with? Will they still exist in five years? Do they invite me onto yachts for parties? But by far the most important factor is cost. Buyers want to minimize cost, not maximize visibility coverage.

Why would buyers not pay a premium for more complete data coverage, better data accuracy, or covering all modes & regions in one tool? Because visibility has a paucity of proven business cases. We absolutely see robust business cases (and therefore investment in premium visibility) in sectors like pharmaceuticals where primary and secondary packaging must have a provable chain of custody. But most physical supply chains don't need that kind of “no sparrow shall fall without us knowing” level of visibility.

Given that the marginal returns on visibility just don't matter to most businesses, bundling a basic version of visibility with other services turns out to be the market-share winning move. It reduces IT vendor count for the buyer, brings cost of ownership down, and avoids integration risks. Most shippers get their visibility via core systems or as a perk from their business partners. Those that don't would usually prefer to do so if offered.

A Financial Reckoning is Coming

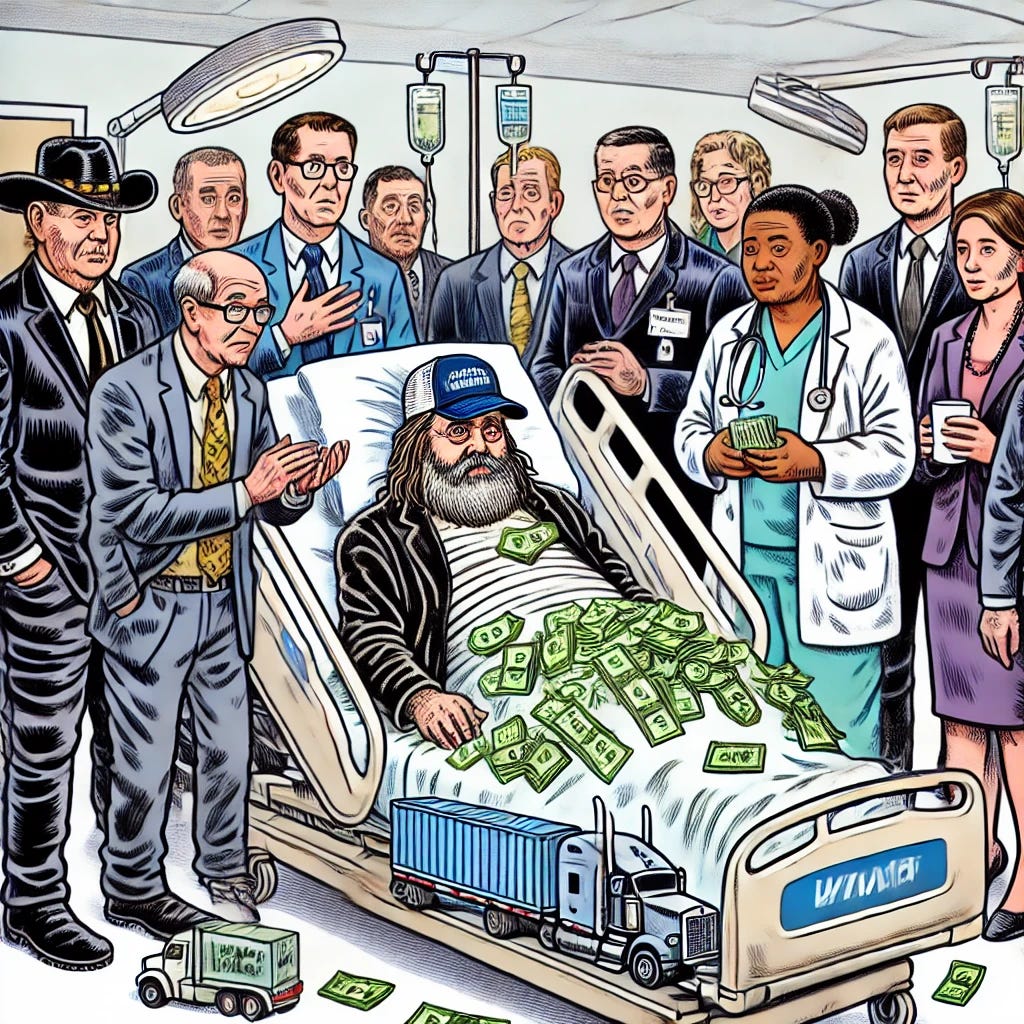

The three VC-backed visibility vendors were all formed in 2014. Since then, Project44 has burned through about $900 million in funding, FourKites about $250 million, and Shippeo more than $100 million. That is $1.25 billion in funding that expects about 20% internal rate of return. To make the math simple, these companies need to be able to return at least $5 billion to investors. I believe the liquidity event is supposed to look like this:

But that isn’t going to happen.

At these levels of enterprise value only the largest private equity or public markets are possible routes to liquidity, and both would expect to see at least $400 million in revenue under normal SaaS margins. I doubt that these companies have between them more than $300m in revenue, and they are loss-giving rather than highly profitable.

While venture capital understands risks and winner-take-most dynamics, even a single winner wouldn't give the necessary payback. Although it sounded good in 2014 to pitch the “you have visibility to your Amazon order and Domino's pizza, so why not your truckload of FMCG products?", the TAM calculations simply were wrong. De-industrialisation and de-globalisation played their part. Material supply chains are an ever smaller role in the economy (compared to services) and international trade peaked in 2011, declined subsequently, and is expected to deeply retract under the second Trump administration. But the major theme is an inverse of John Maynard Keynes's famous statement: the market is staying rational longer than the VC backed providers can stay solvent. In order for someone to cash out the investors from Project44, for example, they have to bet on increasingly unrealistic revenue growth.

I actually feel deep resonance on this topic in comparison to an article I wrote back in 2020 about the Ponzi scheme of Convoy and UberFreight. At that time I noted that the biggest value these companies gave the trucking sector was to take VC investment and essentially hand the cash over to carriers or shippers. You can get a lot of customers when you offer to sell $1 for $0.60 (and yes that is the rate at which they were subsidizing transportation in 2020). But it eventually comes to an end. In that case the clever answer from bulls on those businesses was that they could raise prices on shippers back up to market norms, slim down their inhouse costs to normal brokerage levels, and become a very large 3PL wit normal 3PL margins. My hunch was that churn would eliminate the expected gains: logistics is very price sensitive and degrading service while increasing prices is not something shippers would miss. Skip ahead some years and bingo, that was the right call. Convoy is dust and UberFreight is basically Transplace plus a lot of unprofitable noise. It doesn’t matter how mighty a company looks with big funding rounds and unicorn status. You cannot eat valuations: free cashflow is king in the world of grown up companies, and public markets cut through the self aggrandizing marketing.

So, what next? I strongly doubt any of these VC-backed visibility vendors will stay focused on that category through 2026. I'm not saying these vendors have not achieved product-market fit, I'm saying their cost structure means they already charge 25% more than my company (and others) do for the same product and yet still cannot make a profit. That's not going to get easier: prices for visibility should fall in the coming two years rather than increase. With a price-war on the revenue side, limited interest & down-rounds on the equity side, and higher cost of debt on non-dilutive funding side… something has to change. I see two ways for these vendors to exit visibility.

The first is to get acquired, dismantle the company (to cut costs), and become someone's feature. The kind of buyers who might do this include BlueYonder, SAP, and Maersk. More financially disciplined software companies like WiseTech and Descartes would probably pass on these deals even at deflated valuations.

The second option is to pivot and use the remaining runway to enter adjacent markets. Dock scheduling, for example, seems to be a likely direction. Whether these pivots work depends on the usual factors of competitive outcomes. What won’t make a difference is their visibility success. That's why I'd call these pivots not extensions. Ironically, as I was about to publish this article I saw that FourKites announced such a pivot. Good for them! I had already been rating FourKites as the most likely to navigate this situation well. Mathew Joseph Elenjickal, their CEO, has guided them for years to roughly match Project44 market share in their home turf of the USA but while burning less than 25% of the capital of Project44. I may have my doubts about the attractiveness of the category they played in but Mathew got a 4x return on invested capital against his nearest competitor and that bodes well for the pivot he is now making prior to Shippeo or Project 44.

It's worth saying explicitly that I don't wish these companies ill will and I don't get a thrill out of predicting troubles for their financial health. In the case of Mathew of FourKites, I started my last business around the same time and have had several nice interactions with him over the years. I'm principally interested in the big picture changes happening here to the industry I devoted my career to: a major software category in supply chain management is evaporating, one that took major attention thanks to $1.25 billion thrown at sales and marketing.

Is This Really About Transporeon?

I'm sure a cynical reader of this article would say it's just unattributed product marketing for my company. On the contrary, I tended to constrain myself from writing in my personal Substack or other forums about my opinions as I took over product & platform at this business. It's been over a year since I last published: I didn’t want to confound a company position with my own, as I'm neither a spokesperson nor marketer. But I think it's time to share more. And, if I can say so, I have a right to a viewpoint of my own on this visibility topic. After earning a master's degree with an emphasis in supply chain management I've been working on visibility since 2010 in projects for companies like Dick's Sporting Goods, Adidas, Build-a-Bear Workshop, HP, Syngenta, Novartis, Panalipina, DHL, Fonterra, GT Nexus, and so forth. I wrote a textbook on supply chain visibility still used in some university courses. And indeed I now lead product and engineering for one of the top visibility vendors. We (Transporeon, now a Trimble company) provide the same visibility solutions as these VC-backed vendors in ocean, air, rail, FTL, Europe, USA, etc, at 25% below their prices. Alongside Descartes we are one of the only top vendors who are profitable and therefore likely to be intact in two years. In 2021, Transporeon had already identified the germane factors I am describing for the visibility market: visibility is best provided as a feature of a larger solution, it should be good but inexpensive (free if possible), and a vendor's cost structure matters the most in the end because we need to drive to de minimis price points. That cost structural consideration was part of the reason why we didn’t enter the USA market with real-time truck and rail tracking until 2024. Only with the merger with Trimble did we have a distinct cost advantage in the data lifecycle and sales channels in the USA, something that we followed through on to win significant logos at massive undercuts to the typical price for the region. But is this article about Transporeon and Trimble? Nope. Those are the least dynamic of the vendors because they are the ones that will exist in the same form in two years. The real drama in visibility will be in those pivots and abandonments of independent visibility businesses that I predicted along with the scramble by folks like Gartner to scrap a category of Magic Quadrant that vendors no longer consider relevant before they likewise are seen as irrelevant. An increasingly challenging task in a world of bespoke deep research reports from Generative AI for a fraction of the cost of a Gartner briefing or membership. But that is the story for another article and another day.

I got to see the rise and spectacular fall of this space with my own eyes. From my point of view, these companies simply sourced data or blatantly stole it by paying people to break captchas. I always felt their business models were in shambles because it only took 1 major data supplier to block api access to their data to make them completely useless. On top of that, their leadership team was completely inexperienced and lacked basic discipline and leadership skills, causing absurd levels of rotation at key executive levels and unnecessary spending across the board. They’ll surely be better off getting bought by a bigger player, competition is fierce out there and these people are not true technologists, the pond has gone dry at this point…